This study presents a comprehensive collection of access control statistics. It shows how security is changing fast.

Savvy intruders are finding new ways in. They use both physical and remote methods. This is a big concern.

The report focuses on workplace security. It looks closely at how well physical access controls work.

Here are the main points:

Summary findings:

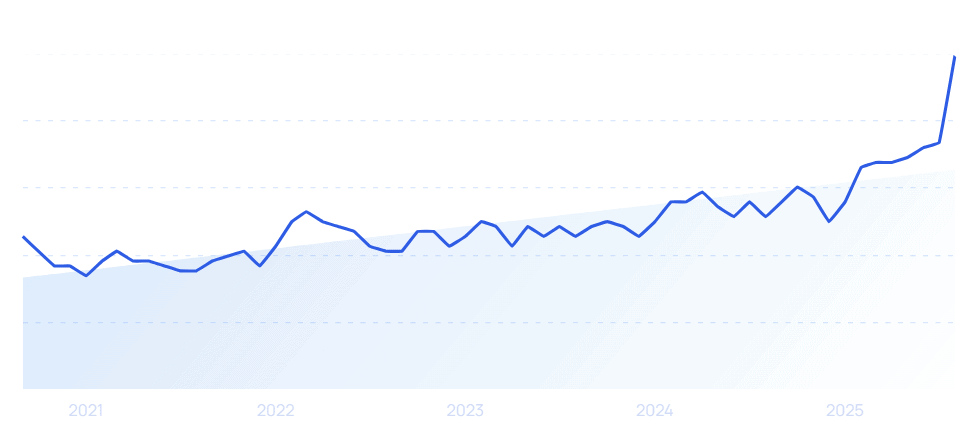

1. Access control experiences 119% growth over the last 5 years from 2021 to 2025.

2. 60% of organizations still using ID badge access control.

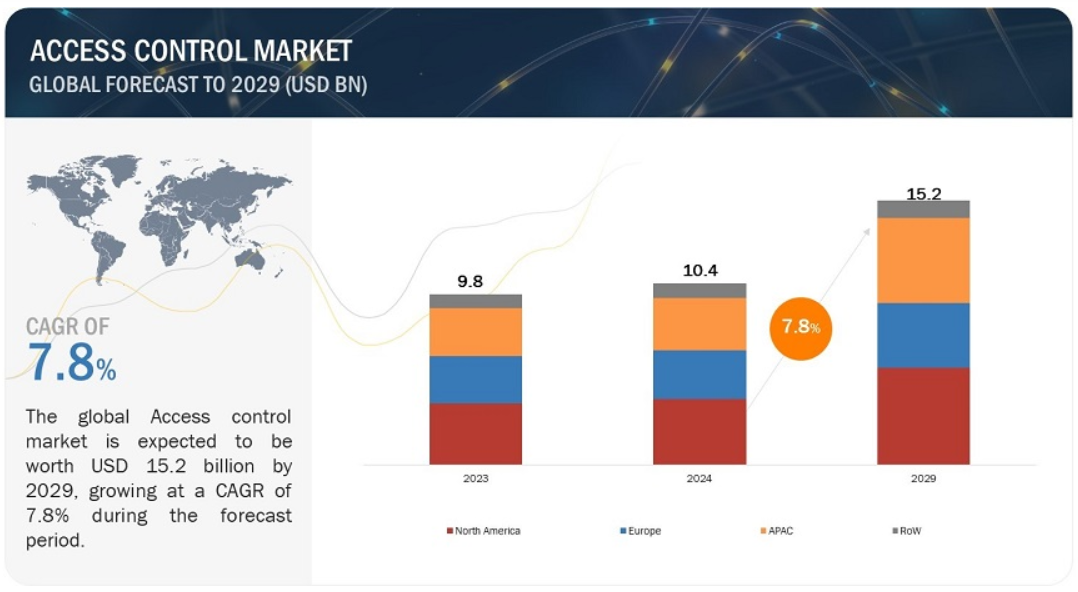

3. Access control market to grow from $10.4B in 2024 to $15.2B by 2029.

4. Smartphone is the #1 choice to unlock their workplace.

5. 66% prioritize security over convenience in office settings.

6. Contactless biometrics to surge at 17.4% CAGR through 2030.

7. 53% seek to improve secure remote access control for rising hybrid work.

8. $20 rent hike funds access control upgrade in 3 years, 39% gain in 5 years

9. Over 70% of organizations with access control report less than 5 major incidents each year.

119% growth in access control

Access control demand surges due to rapid technological advancements and escalating security challenges. From 2021 to 2025, the access control sector has expanded by 119%, reflecting its increasing importance in security.

The sector is predicted to continue growing as security threats become more sophisticated.

As of 2026, Semrush reports a monthly global search volume of 47.4k for "access control," with the highest interest in the US (12.1k searches), India (6.6k searches), and Thailand (2.4k searches).

Key Takeaway:

Growing security needs drive access control market expansion.

60% stick with ID badge control

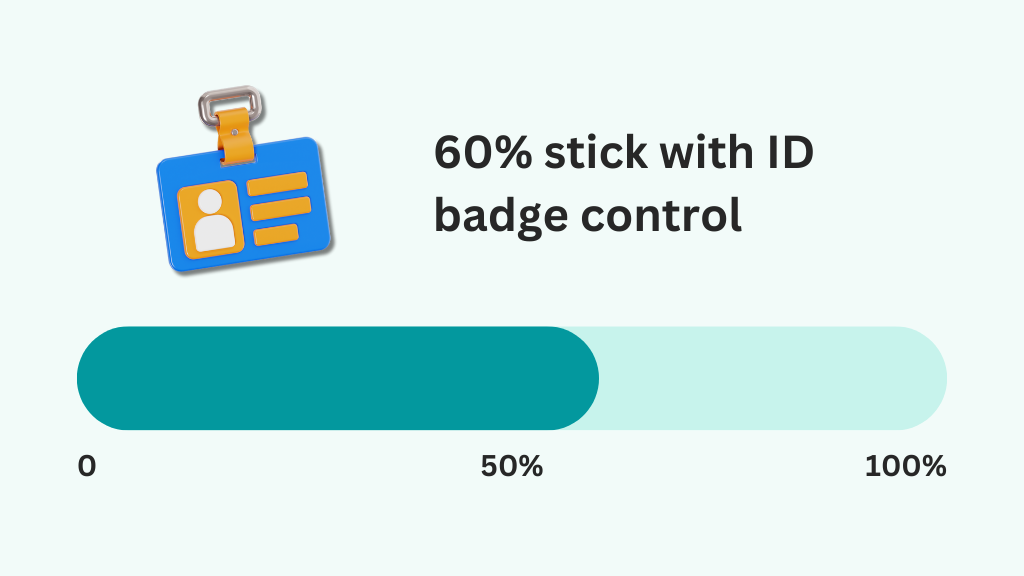

Access control technology has significantly evolved recently, with advancements in mobile, biometric, and QR code technologies.

In 2022, despite the emergence of newer technologies, 60% of organizations still rely on ID badges for access control.

This is followed by secure computer/network logins (55%) and time & attendance systems (50%). Meanwhile, mobile IDs (32%) and biometrics (30%) are less commonly used.

Here’s the breakdown:

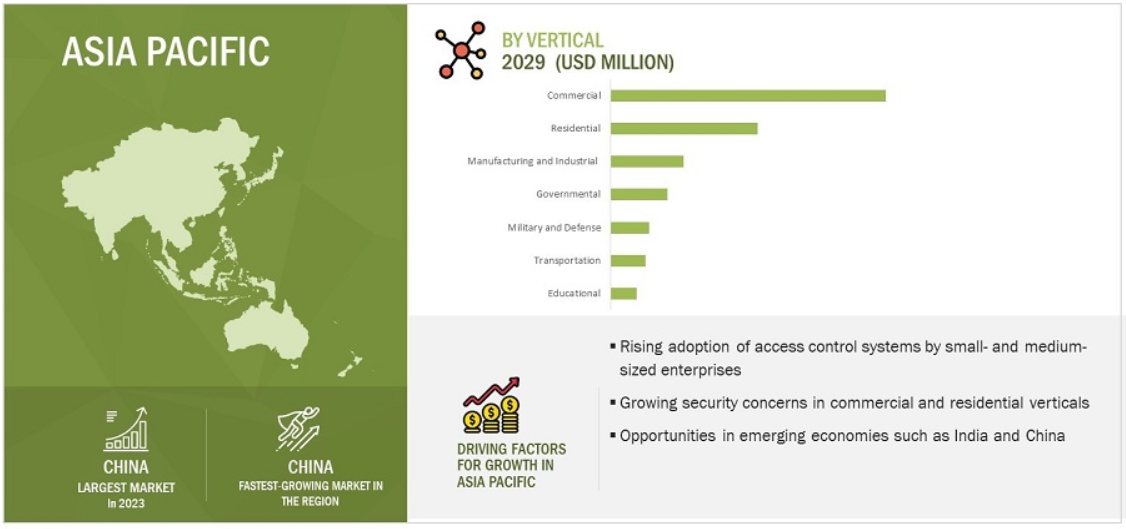

Surprisingly, the adoption of biometrics is higher in the Asia Pacific, particularly in China and India, with expectations for the use of newer technologies to increase.

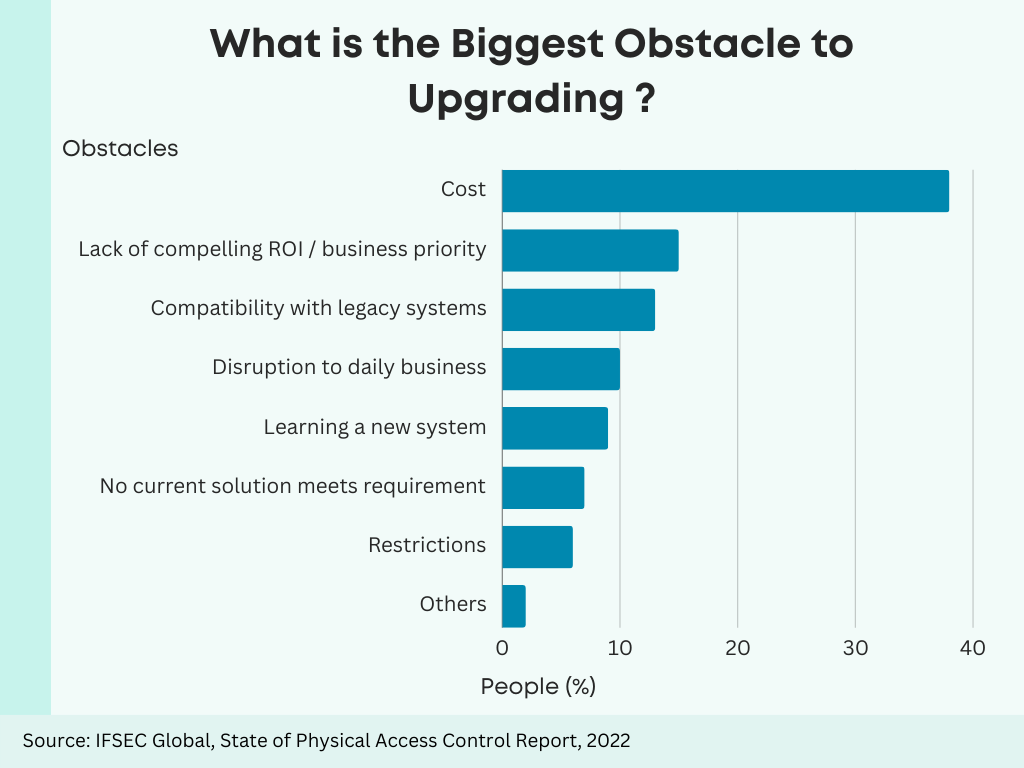

Upgrading access control faces hurdles: cost (38%), uncertain ROI and prioritization (15%), and compatibility issues with existing systems (13%).

Key Takeaway:

ID badges dominate despite newer tech's rise.

Market to grow $10.4B to $15.2B by 2029

As of 2023, the global access control market is valued at $9.8 billion.

By 2029, the market is expected to reach $15.2 billion, growing at a CAGR of 7.8% during the forecast period.

North America leads in market share, with significant growth in Asia Pacific driven by smart city projects.

Commercial sectors in AP, especially SMEs, lead in adoption, followed by residential sectors.

Growth factors include demand from smart homes, increasing security breaches, rising cloud-based access control adoption, and IoT integration.

However, high installation, maintenance costs, and low awareness could slow growth.

Key players include:

- ASSA ABLOY (sweden), dormakaba group (switerland)

- Jhonson Controls (Ireland),

- Allegion Plc (Ireland)

- Honeywell International Inc (US)

- Identiv, Inc (US)

- Nedap N.V (Netherlands)

- Suprema Inc (South Korea)

- Bosch Security Systems (Germany)

- Thanes (France)

Key Takeaway:

Robust growth driven by technology adoption and security needs.

Smartphone is #1 choice for workplace access

98% of office workers own smartphones, with their use for access control on the rise.

The industry is predicting exponential growth in mobile credentials over the next few years:

Access is managed via a mobile app or web interface, where administrators can grant or revoke access by sharing or deleting a digital key, allowing doors to unlock automatically.

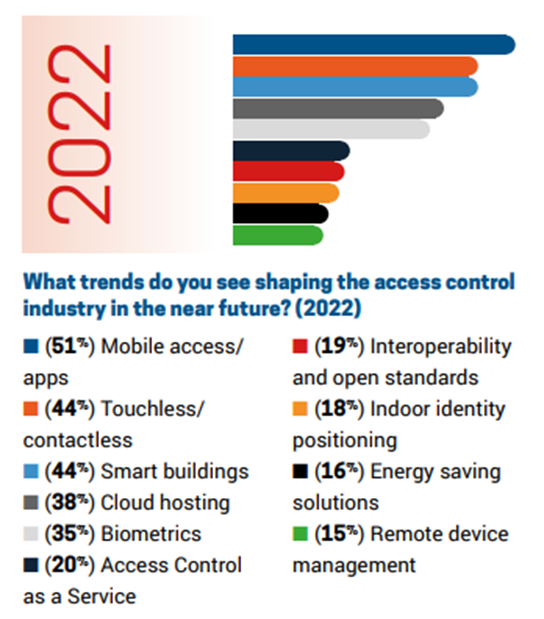

In fact, the majority 51% see mobile access shaping the access control in the future.

source: IFSEC Global

Mobile access systems, primarily using Bluetooth Low Energy or NFC technology, are becoming more widespread, highlighting the advantages over traditional RFID cards.

Key Takeaway:

Smartphones revolutionize workplace entry methods.

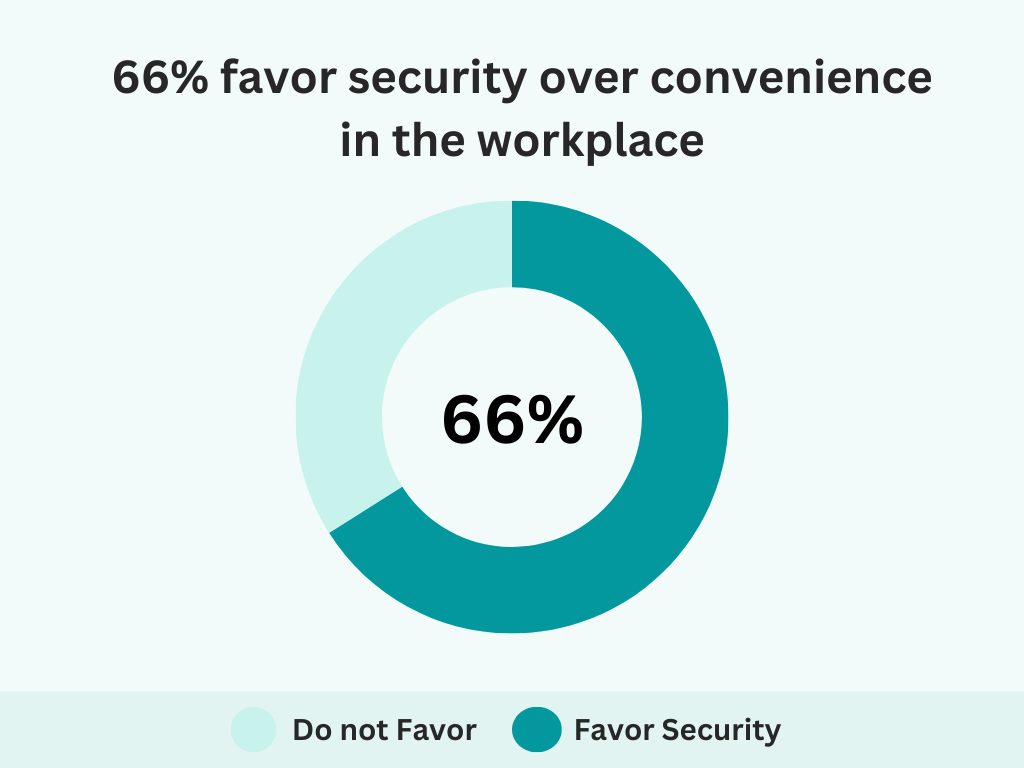

66% favor security over convenience in the workplace

Balancing high security with ease of access is challenging.

In 2021, a Nexkey study of over 1000 employees found that 66% of office workers prefer security over convenience, consistent with 2020.

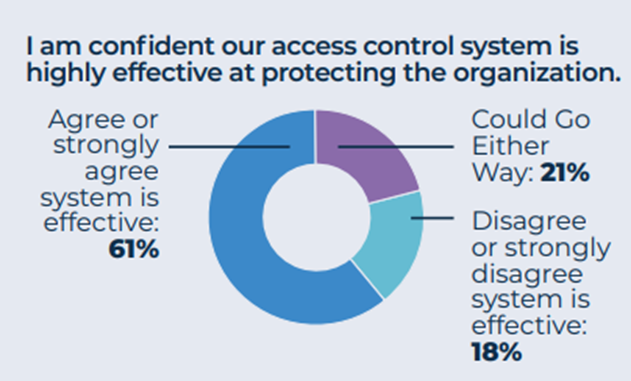

A related study indicates that 61% believe access control systems effectively protect organizations, whereas 18% do not.

Additionally, 44% of respondents feel access control is more important post-pandemic, highlighting the need to eliminate manual surface contact for entry or exit.

The emphasis on security over convenience is expected to continue, with advancements in access control technology focusing on balancing these aspects more effectively.

Key Takeaway:

Security remains a top priority for office workers.

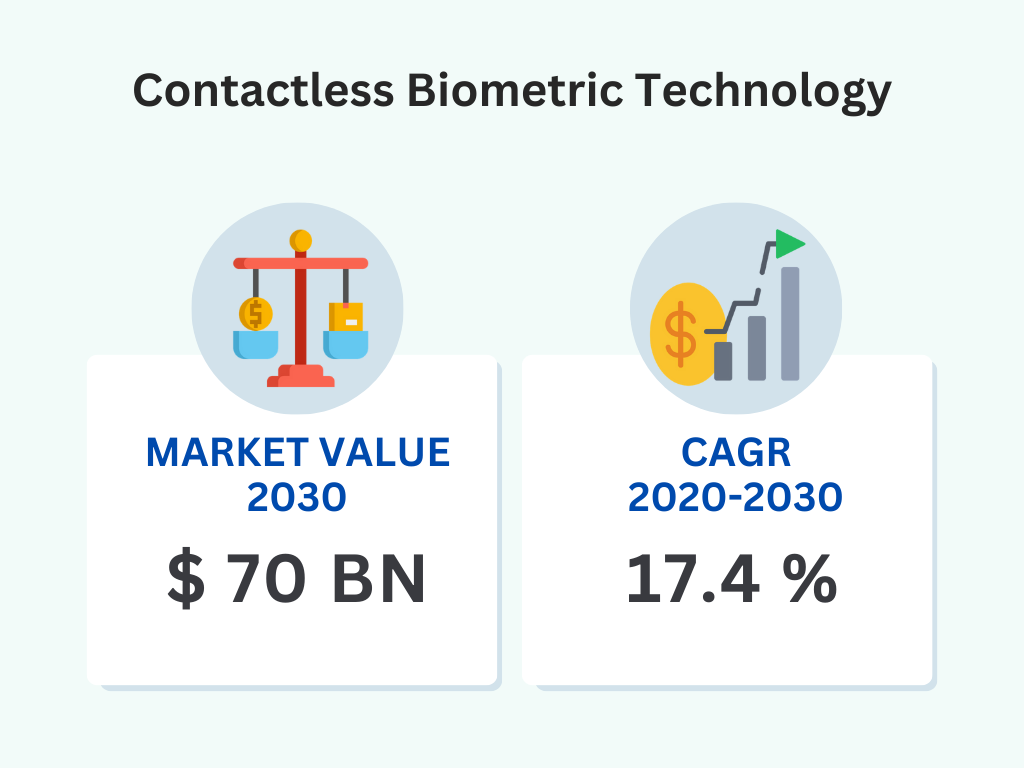

Biometrics CAGR 17.4% '20-'30; market to $70B

Facial recognition technology is widely used for unlocking phones and PCs.

By 2030, contactless biometric technology is projected to expand at a 17.4% CAGR, reaching a market size of $70 billion.

Facial recognition is expected to hit nearly $2.3 billion by 2025, with biometrics-as-a-service growing to $3 billion. (source)

Facial recognition's popularity stems from its ease of deployment, contactless nature, and rapid identification capabilities.

As of 2022, 60% use ID bages, 32% use mobile IDs, and 30% use biometric technology for access. (source)

Seventeen percent of people using biometrics intend to switch to advanced biometric solutions, while 19% plan to move to mobile access.

This suggests a shift towards more contactless and secure technologies.

Contactless biometrics will get better at recognizing faces even with masks on, stopping fake attempts, and understanding emotions, making it more useful and popular.

Key Takeaway:

Rapid growth in contactless biometrics driven by technology advancements.

53% prioritize improving remote access control

With the shift back to offices in a hybrid model, seamless connectivity is crucial for business continuity.

In 2021, a survey of 302 IT and business leaders revealed that 53% seek to improve secure remote access control, with 49% implementing or upgrading network access control or zero trust network access.

This is due to the rise of remote work and hybrid work models has impacted the need for access control solutions in physical office spaces.

Furthermore, 84% of respondents from financial service organizations are increasing remote or hybrid workforce arrangements.

IT and business leaders are striving for higher security and reliability to address the challenges posed by increasing remote work demands.

Key Takeaway:

The majority of organizations are focusing on making remote access control safer because of changing work styles.

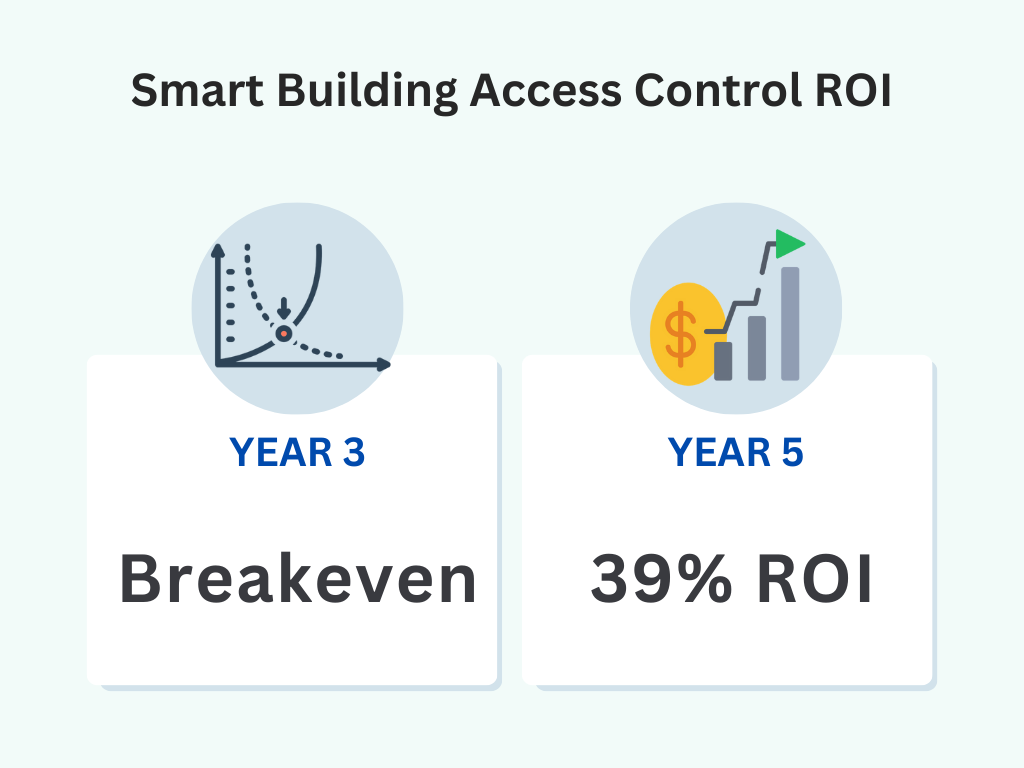

Access control upgrade self-funds in 3 years, 39% gain in 5 years

Single access controls are affordable, but costs for entire buildings can quickly add up, especially when considering integration and maintenance.

For a 250-unit building at 95% occupancy, installing individual door access control, external door sensors, and an intercom system, a $20 increase in rent allows the access control system to become self-sustaining within three years, with a five-year internal rate of return (IRR) of 39%. This demonstrates a strong business case for the investment based solely on the rent increase.

Here's the breakdown of ROI analysis:

ROI calculations can be complex, and when additional benefits like time savings, energy savings, and increased security are considered, the actual ROI could be even higher.

Understanding the full scope of ROI is essential.

Future access control technologies will need to be adaptable to changing organizational needs, enhance user experiences, and integrate seamlessly with new devices.

Key Takeaway:

Investing in better access control pays off in many ways, not just in money, making places safer and more efficient.

70% see less than 5 incidents yearly with good access control

As threats evolve, companies need to revisit their systems and processes to keep up.

In 2023, companies are shifting to more secure technology. Seventy percent report fewer than five serious incidents within a year. This outcome gives security professionals confidence in maintaining a low incident rate.

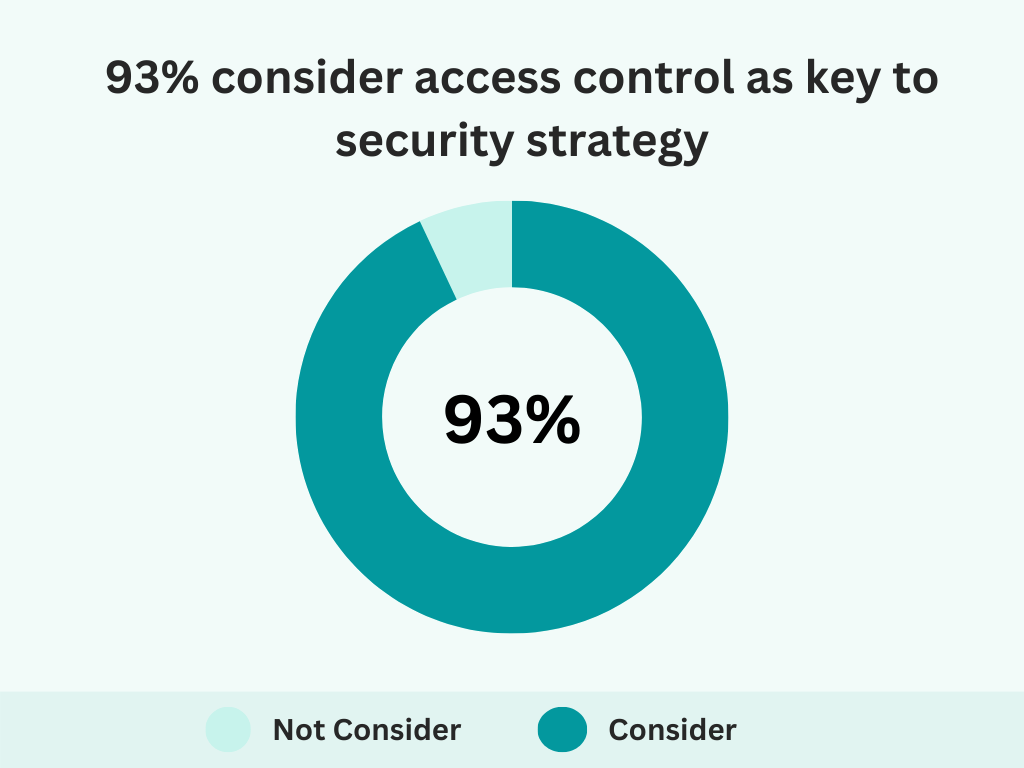

Moreover, 93% of organizations consider access control a critical component of their risk management and security strategies, highlighting its effectiveness.

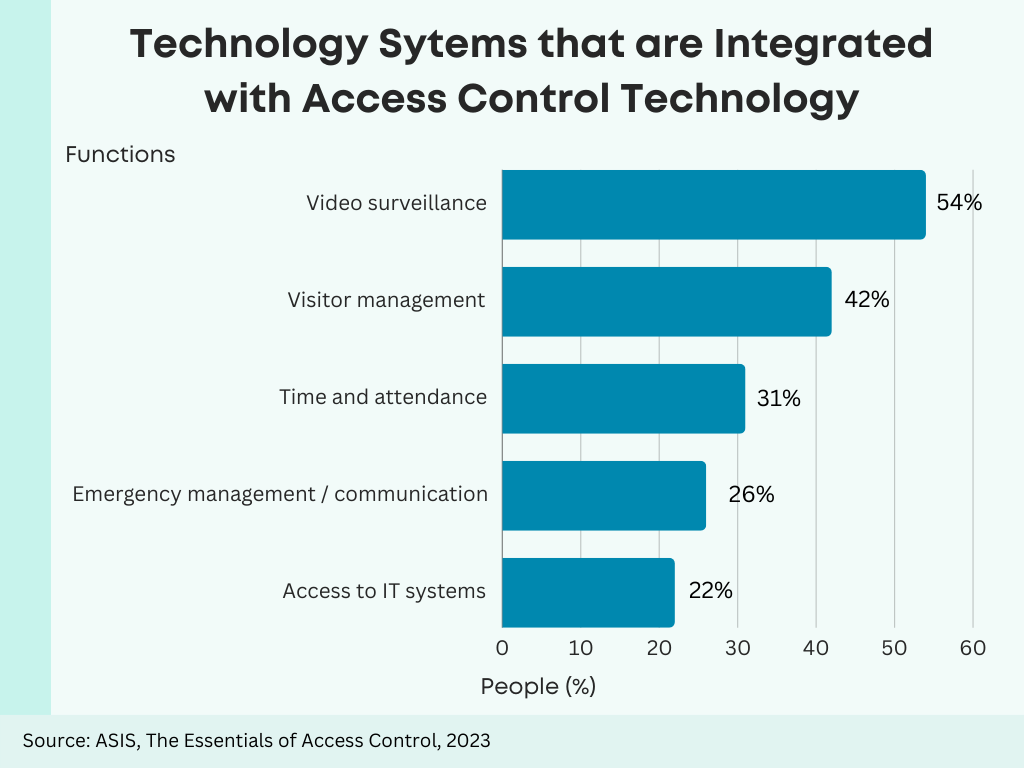

Effective access control integration with other security systems is key to enhancing organizational security. Here’s the breakdown:

Key Takeaway:

Access control is essential for effective security management.

Wrapping Up

The stats highlight a big need for better security. This covers both physical and remote breaches.

To tackle this, we can strengthen access controls. Regular security checks are also key.

What's next looks exciting. Innovations like contactless and mobile access are coming. They promise quick yet secure ways to authenticate.

0 Comments